7 reasons you should stop trading time for money

7 reasons you should stop trading time for money

7 reasons you should stop trading time for money

We’ve always been taught that in order to make money we have to go to work and put in the hours. It’s a simple concept really. I work so many hours and you pay me for each hour I work. The rules are simple. If I don’t work any hours you don’t have to pay me any money. In this lies a really big problem. The concept will limit your earning potential due to the fact that you can never make more money than the number of hours you put in.

Have you ever wondered if there was another way to make money? One that doesn’t really require you to trade hours for dollars? That’s what this blog post is about! Money really is only numbers inside of banking systems being transferred from one account to another. The days of holding physical cash is approaching its end. The question is, how do we get those banking numbers, how can we transfer more of it into our own account!

Here are 7 reasons you shouldn’t trade time for money.

![]()

1 Taxes

Did you know that the government imposes higher taxes on earned income and salaried income employees? Think about that for a minute. Big business owners and investors are taxed at a lower rate than hourly employees. Basically, the harder you work the more money the government takes! To me that doesn’t sound like a racing game I’d want to play. According to Robert Kiyosaki’s book, “The Cashflow Quadrant,” the best place to be is on the right side of the BI triangle. Be on the side of Business Owners and Investors.

Did you know that the government imposes higher taxes on earned income and salaried income employees? Think about that for a minute. Big business owners and investors are taxed at a lower rate than hourly employees. Basically, the harder you work the more money the government takes! To me that doesn’t sound like a racing game I’d want to play. According to Robert Kiyosaki’s book, “The Cashflow Quadrant,” the best place to be is on the right side of the BI triangle. Be on the side of Business Owners and Investors.

2. Your Time can never be given back to you

Time is one currency that only goes in one direction. Away from us. We only have a finite amount time to be happy and live fulfilling lives. Spending 40 plus hours per week trading time for money must have been invented by a knuckle head to be blunt. Imagine if you spend 40 hours a week self-educating yourself. Or spend those same hours building a business. Or those same hours mastering your own craft?

In the end, we will always wish that we spent more time doing the things we love. By trading so much time for money, we never even have time to get in touch with our own genius. They told us that we need a safe and secure job, and that means we cannot pursue our passions. Just remember this, all that time you’re spending trading time for money is to build something that doesn’t even belong to you. To make another person rich with your own cherished time.

3. Your money is limited to 24 hours a day.

3. Your money is limited to 24 hours a day.

As I said earlier, the money you make is tied to how many hours you can actually work. Unfortunately, this is a dead end. After much study and self-development, I have found that money can actually work more than 24 hours in a day. I have created businesses that allow my money to work for me. Ever considered giving your money a job? Put it to work and you’ll see that it never needs to take a break and can work much more than 24 hours in a day. I’ll teach you some simple tricks on how to achieve this in another post!

4. You won’t go very far Trading time for money.

4. You won’t go very far Trading time for money.

Being that the amount of money you can earn depends on how much work and hours you can put in, your income can only go but so far. It can go as far as how many hours you can work. Here’s an alternative you might want to consider: Imagine if you could use the hours someone else puts in to earn you money? You could hire or convince more and more people to help achieve your dreams of being wealthy!

Being that the amount of money you can earn depends on how much work and hours you can put in, your income can only go but so far. It can go as far as how many hours you can work. Here’s an alternative you might want to consider: Imagine if you could use the hours someone else puts in to earn you money? You could hire or convince more and more people to help achieve your dreams of being wealthy!

This, however, is a concept known as OPT. (Other People’s Time). An even more advanced approach is OPM, (Other People’s Money). You’ll know you’re winning the game of money when you’re using OPM and OPT!

![]()

5. Just because you built it doesn’t mean it’s yours.

What amazing things you all have built here in the office.” A quote from a CEO.

“Thanks to your hard work here in the office, I can go build an even bigger home for myself.”

“We’ll talk about that pay raise next year!”

What’s happening here is what happens all too often. Employees work day in and day out to create an asset that someone else will get to enjoy.

Here’s a better way of thinking: If you’re smart enough to build someone else’s business, you’re probably smart enough to build your own! Just saying.

![]()

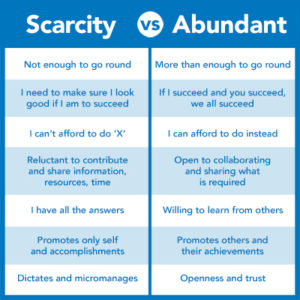

6. It puts you in a mindset of security rather than abundance

A safe and secure job is what we’ve always been taught to look for since grammar school. But consider everything that happened during the 2007 crash. A great many of “safe” and “secure” jobs disappeared in the blink of an eye. And you know who hurt the most? Salaried and hourly employees. Business owners and investors made it out!

And you know what they did next? They created even more wealth from the crash since homes, property, and stocks were all on sale. They purchased those assets at a discount while salaried and hourly employees were stuck looking for the next safe and secure job! Let this be a good lesson. Hourly jobs and salaried jobs can be just as risky as being an entrepreneur. Perhaps even more riskier than building your own business.

![]()

7 It doesn’t teach you true financial education

If you think having a savings account is enough for good financial IQ, then think again. Mysteriously enough, financial education is not taught in schools at all. I’ve learned so much about money being out of school that it really blows my mind! It almost feels like this is an intentional system that we live in.

Having good financial education is key to living out your dreams and desires. What you don’t know will hurt you! Believe me when I tell you that ignorance is NOT bliss! Had any of us had assets spread out into various sectors and asset classes, the 2007 crash would have just been a small inconvenience.

Conclusion

Focus on you and pay yourself first! Take 10 percent of all your weekly earnings and put it towards building an income generating asset. An income generating asset is something that puts money in your pocket every month, no matter how little. By paying yourself first, you’re building the bridge towards financial freedom each and every month, with each and every pay check. Additionally, focus on your own financial education and learn the tricks and Master the game of Money! Wealth, Money, Abundance, it’s all yours for the taking!

I think you get the message I’m trying to get in your head. Build your own business. Take a step and perhaps become an entrepreneur! It’s less risky than a 9-5 job. This has been said by many of the wealthy people we’ve interviewed.

I look forward to seeing you at the top!

If you enjoyed this post please share it!